Watch the below 2 minute quick video tutorial to get started with Simply Track Import.

Simply Track , simplifies portfolio tracking and IRS Schedule D generation.

To get started using Simply Track with minimal setup, please follow these steps

- Sign up and creating user

- Setup a New Account

- Import Your Trade

- Fix Your Data issues

- Run Reports

- Print Schedule D-1 Report for efiling or Export to Other Tax Software

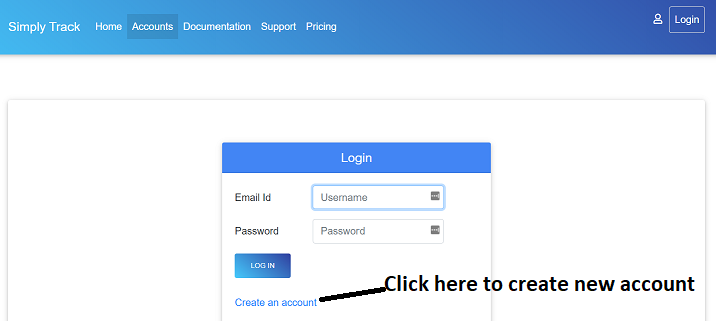

You must create user and password to securely login and use the

Simply Track. To create new user click on login button in top

right corner and then click on Create an account as show below

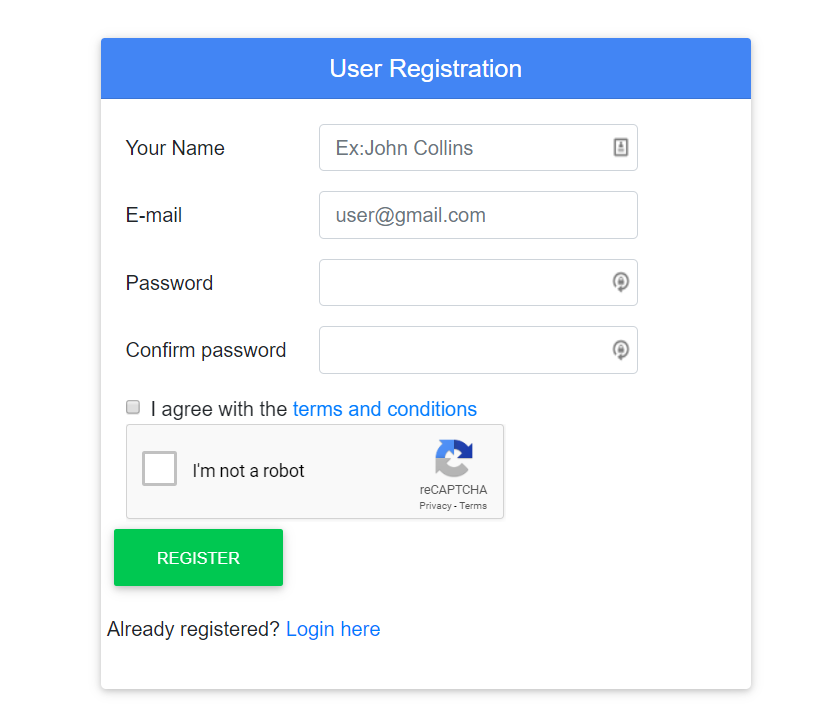

Once you click the Create an account , you will be shown windows like this. Go ahead and fill the information to Sign up new user.

After creation of new user , you can login to Simply Track Application.

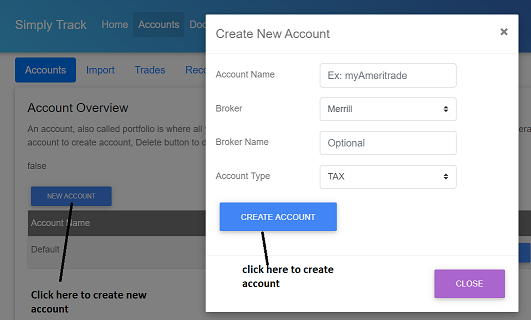

Once you login for the first time, simply tack automatically creates a default account for you. You can use the default account or, click on new account button to set up a new account as shown below. In the below screen, selecting the broker is an optional.

Simply track account holds all your trades. You can have as many accounts as you like. We recommend setting up one account for each broker you trade with. For example if you have trading accounts with Fidelity and E-trade then you will create two accounts in Simply Track with the names fidelity & E-trade so that you can easily reconcile them back to your online broker.

Watch the below 2 minute quick video tutorial to get started with Simply Track Import.

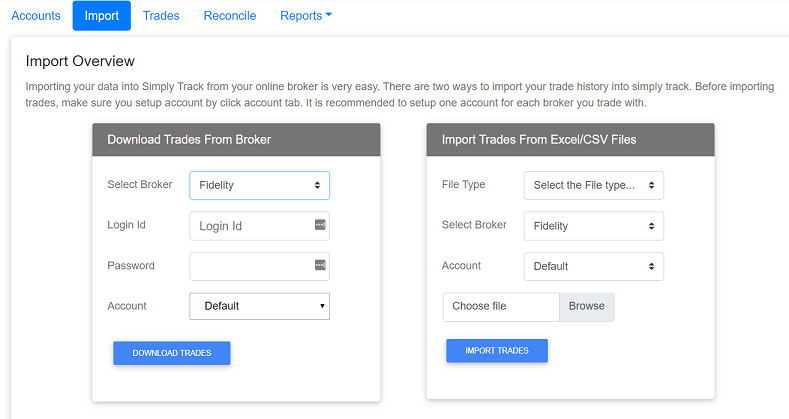

There are two ways to import trades into simply track:

- Directly downloading from your broker.

- Importing trades from a csv/Excel files

We recommend importing using csv/Excel files, as many online brokers change their servers frequently. Note that direct download may not work all the time.

Direct Download – Only a select few brokers are supported. At this time, we are working on adding more brokers for direct download.

Importing from files

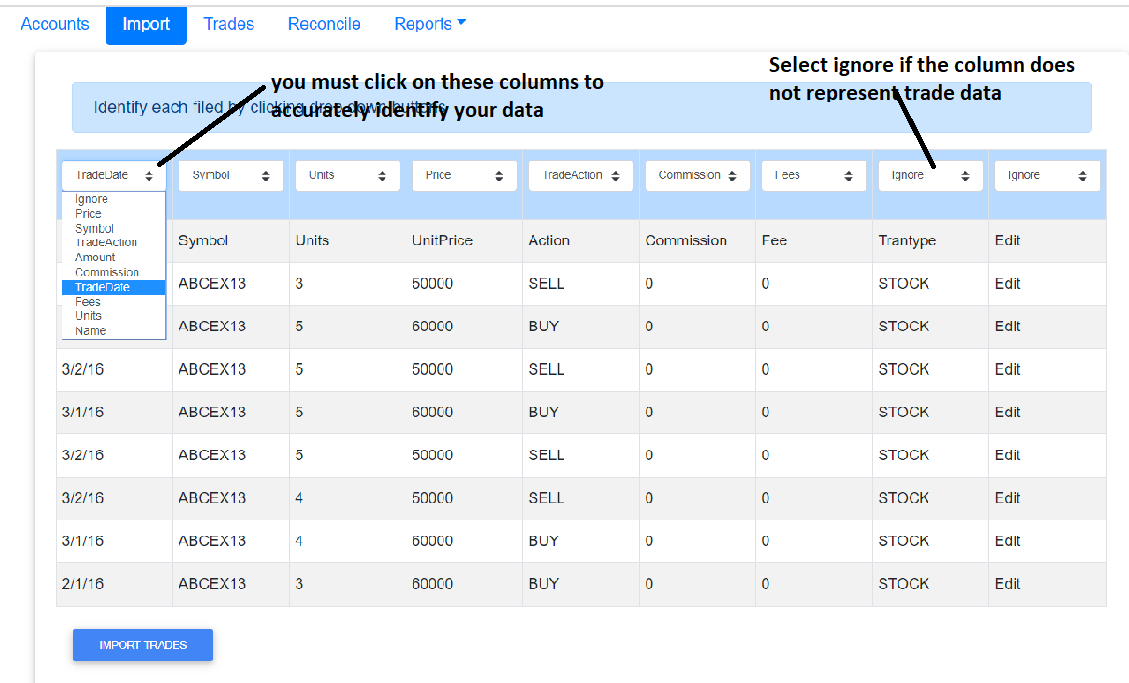

Simply Track can easily import any csv file, irrespective of the broker you trade with. We recommend using the Simply Track format to import the trades. While importing, you will get an option to map your columns in the CSV/Excel files with Simply Track as shown below. If you accurately map your columns, you will not run into any issues during the import stage.

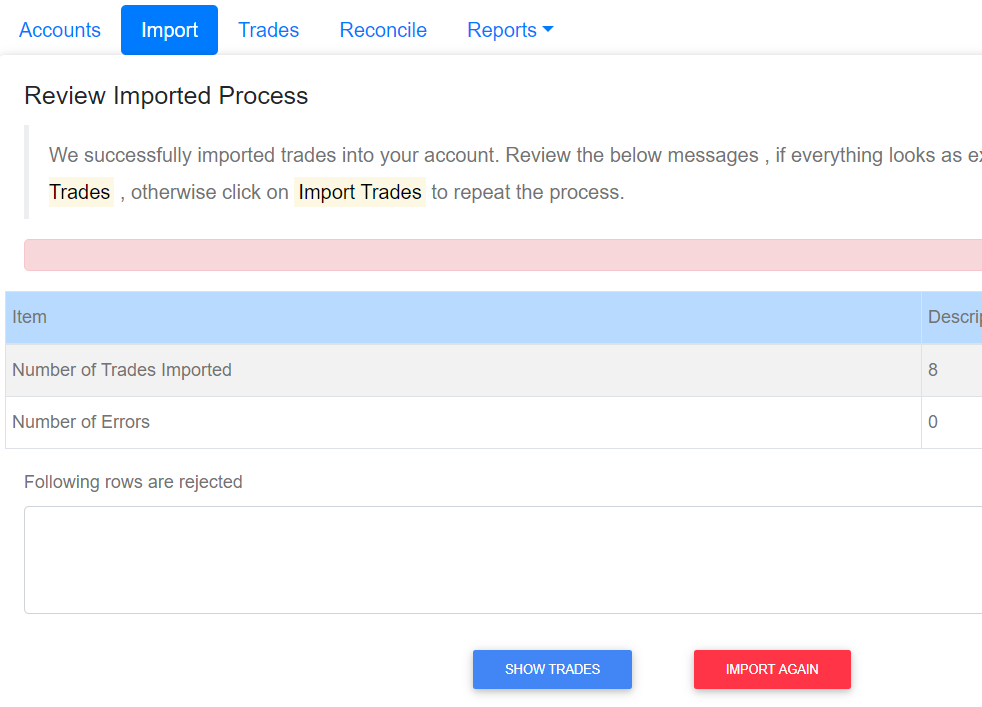

On successful import, a review page is displayed as shown

below. You can either accept these trades by clicking the “show

trades” button or click on “import” again to repeat the

process.

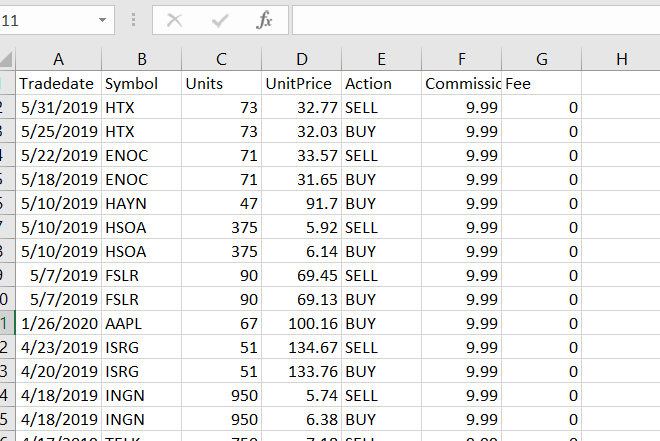

Import trades using Simply Track Format

Simply Track follows following format. If you set up your

trades as shown below, then you easily import your trades into Simply Track

Check out this document for instructions on how you can import trades using Simply Track format.

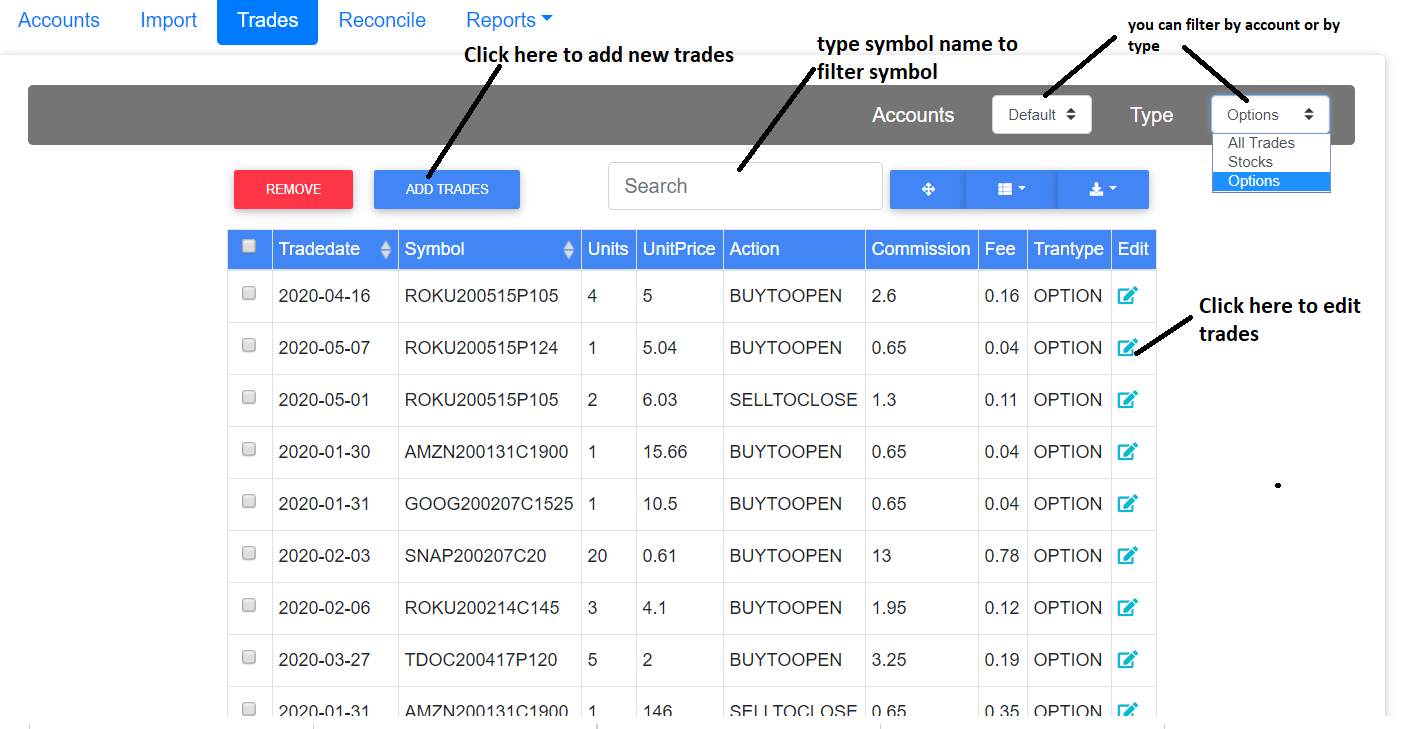

In this window you can

- add a new trade,

- edit a trade,

- remove a trade, and

- you can export a trade into an Excel/CSV file.

- You can also filter the trade by Symbol, Account, Options, or Stocks.

Simply Track can support up to 50,000 trades. It can load these

trades extremely fast and you can work with these trades

efficiently. You can add Stocks or Options by clicking “Add

Trades” as shown below.

After reviewing your trades, you can move on to Reconcile tab.

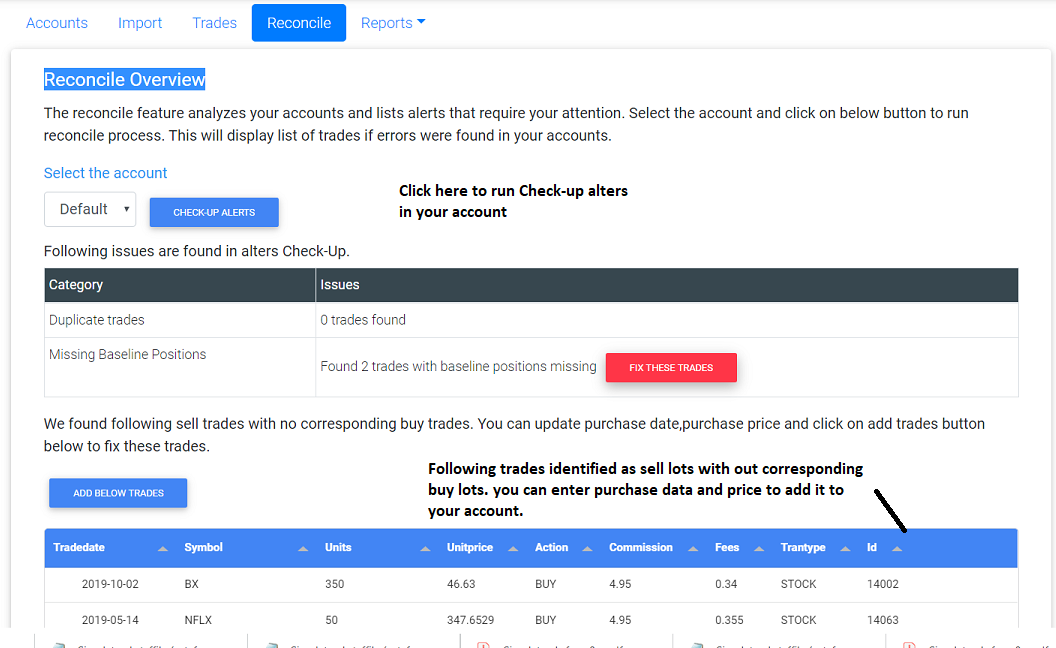

In the Reconcile window, you can analyze your accounts and list alerts that require your attention. It identifies trades that do not match during the trade matching process. For example, if it finds a sell trade without a corresponding buy trade, it will flag the trade as an error. Such trades can be added to your account as shown below.

After reviewing your trades, you can move on to Reports tab and run your Tax reports..

Simply Track provides following report categories

- Realized Gain/Loss

- UnRealized Gain/Loss

- Wash Sale Report

- Wash Sale Analysis

- Tax Reports

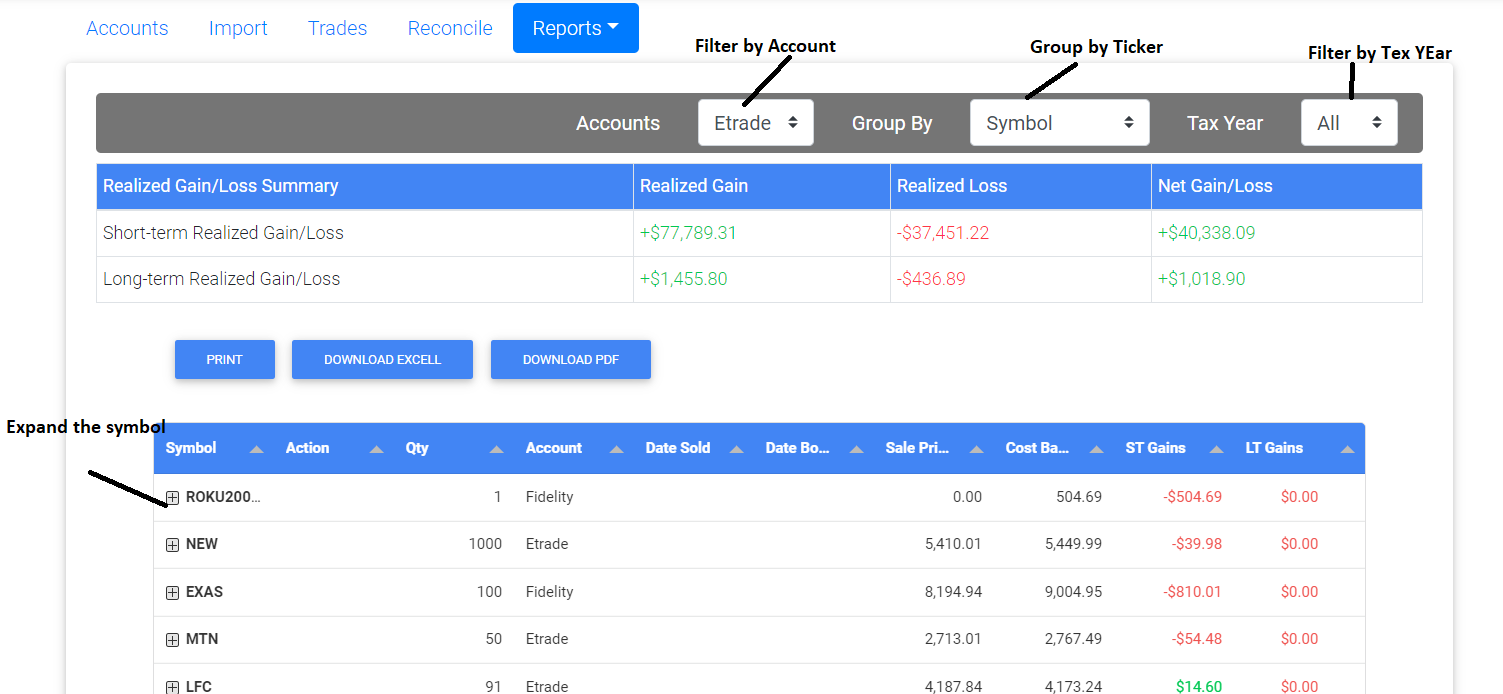

Realized Gain/Loss

Realized Gain/Loss This report produced realized gains and

losses as shown below . you can filter the trades my account ,

you can combine all your accounts to review the consolidated

realized gains by select “All” in the filter. You can also

filter this report by Tax year. This report also combines gains

and losses by ticker symbol.

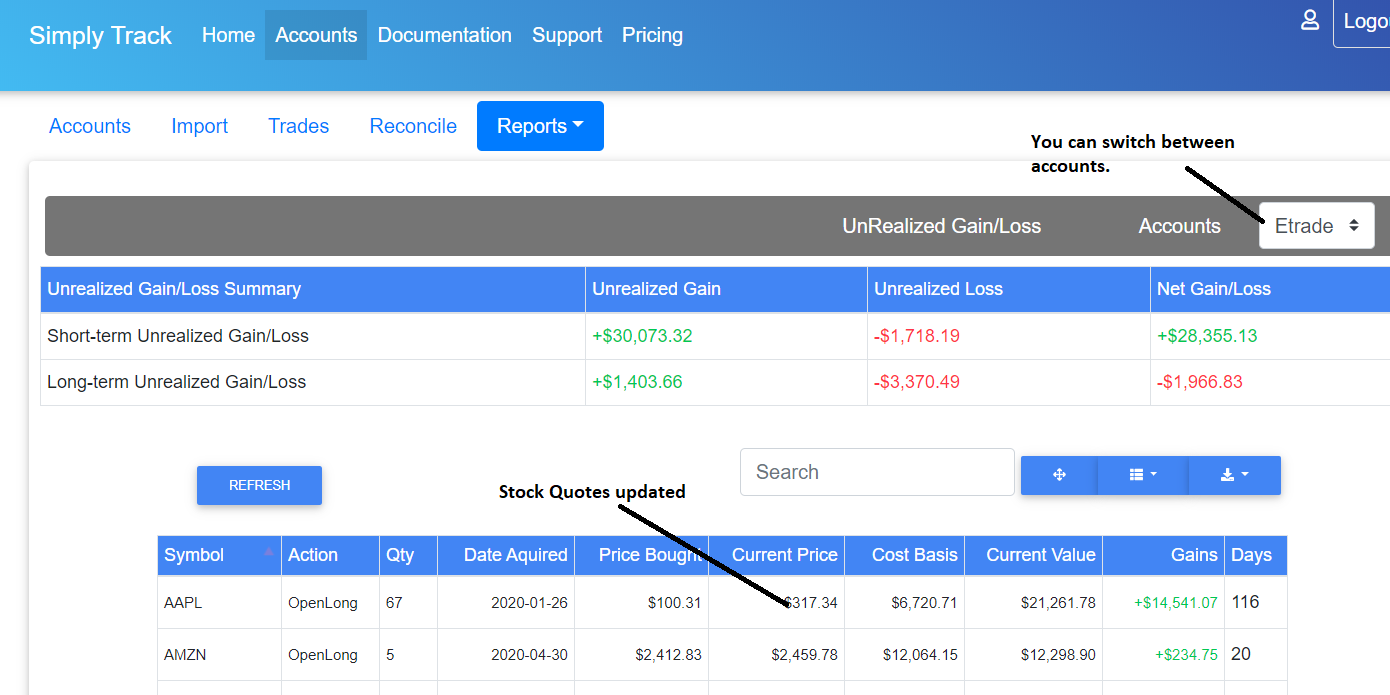

Unrealized Gain/Loss

Realized Gain/Loss This report produced realized gains and

losses as shown below . you can filter the trades my account ,

you can combine all your accounts to review the consolidated

realized gains by select “All” in the filter. You can also

filter this report by Tax year. This report also combines gains

and losses by ticker symbol.

Simply Track adjusts for wash sales as outlined by Publication 550 – across all accounts including IRAs, across stocks and options. It then makes the necessary adjustments to cost basis and calculates gains and losses according to the IRS rules for taxpayers.

What is Wash Sale?

A wash sale is the sale and repurchase of the same securities within 30 days. Normally, if you sell shares for a loss, you treat it as a capital gains loss, which offsets capital gains and up to $3,000 of normal income in a given tax year. You can even carry unused capital losses forward to future tax years. However, if you buy back the shares within 30 days, the Internal Revenue Service disallows a loss on the original sale.

Few Examples of Simply Track Wash sale scenarios

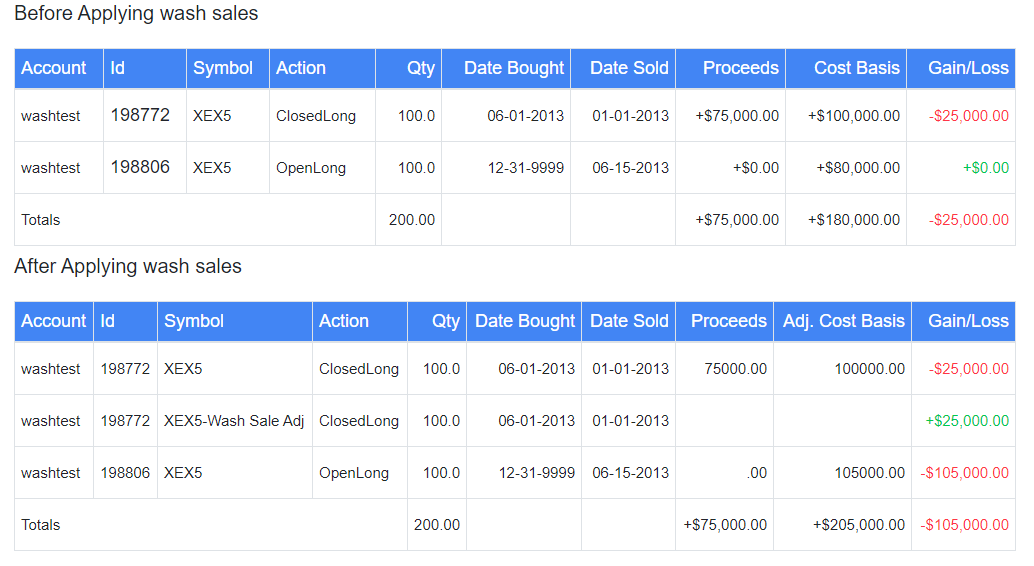

Scenario 1

You buy 100 shares of X stock for $100000. You sell these shares

for $75000 and within 30 days from the sale you buy 100 shares of

the same stock for $80000. Because you bought substantially

identical stock, you cannot deduct your loss of $25000 on the

sale. However, you add the disallowed loss of $25000 to the cost

of the new stock, $80000, to obtain your basis in the new stock,

which is $105000.

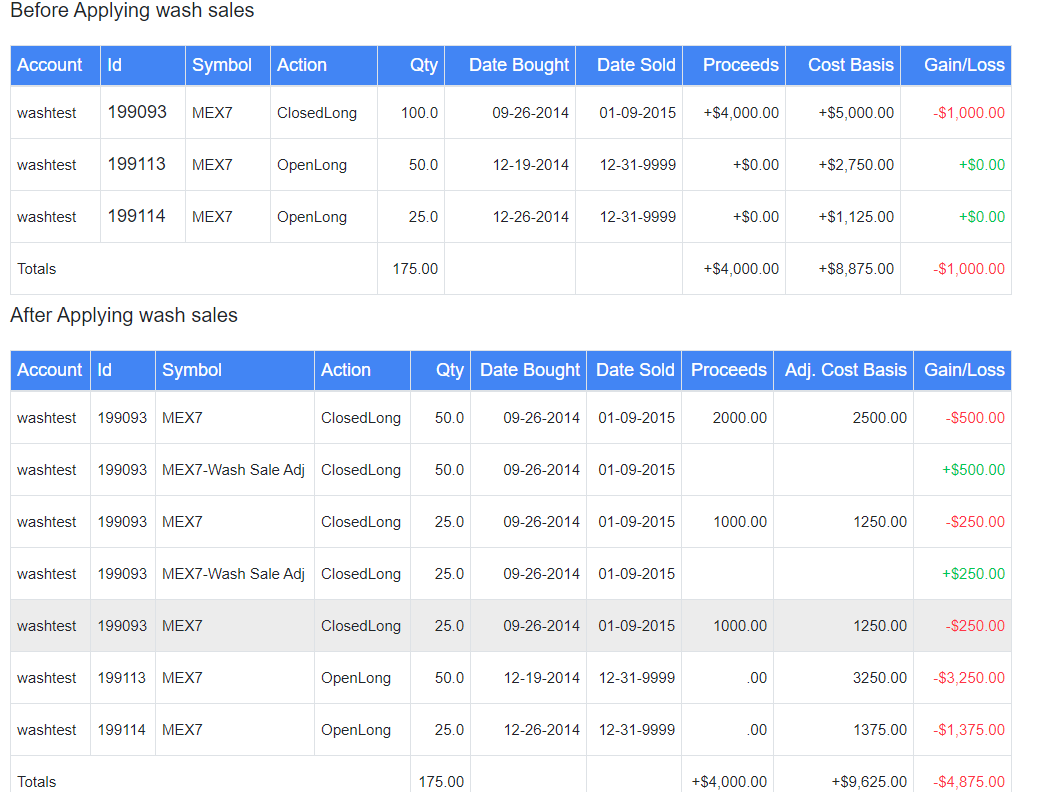

Scenario 2

You bought 100 shares of M stock on September 26, 2014, for

$5,000. On December 19, 2014, you bought 50 shares of

substantially identical stock for $2,750. On December 26, 2014,

you bought 25 shares of substantially identical stock for

$1,125. On January 9, 2015, you sold for $4,000 the 100 shares

you bought in September. You have a $1,000 loss on the sale.

However, because you bought 75 shares of substantially

identical stock within 30 days before the sale, you cannot

deduct the loss ($750) on 75 shares. You can deduct the loss

($250) on the other 25 shares. The basis of the 50 shares

bought on December 19, 2014, is increased by two-thirds (50 ÷

75) of the $750 disallowed loss. The new basis of those shares

is $3,250 ($2,750 + $500). The basis of the 25 shares bought on

December 26, 2014, is increased by the rest of the loss to

$1,375 ($1,125 + $250).

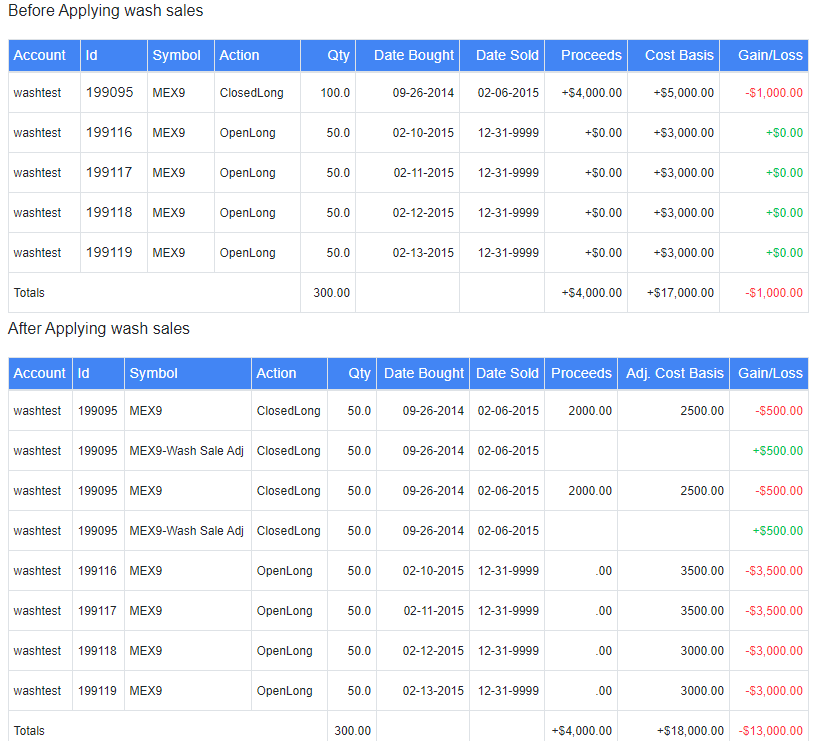

Scenario 3

You bought 100 shares of M stock on September 26, 2014. On

February 6, 2015, you sold those shares at a $1,000 loss. On

each of the 4 days from February 10, 2015, to February 13,

2015, you bought 50 shares of substantially identical stock.

You cannot deduct your $1,000 loss. You must add half the

disallowed loss ($500) to the basis of the 50 shares bought on

February 10. Add the other half ($500) to the basis of the

shares bought on February 11.

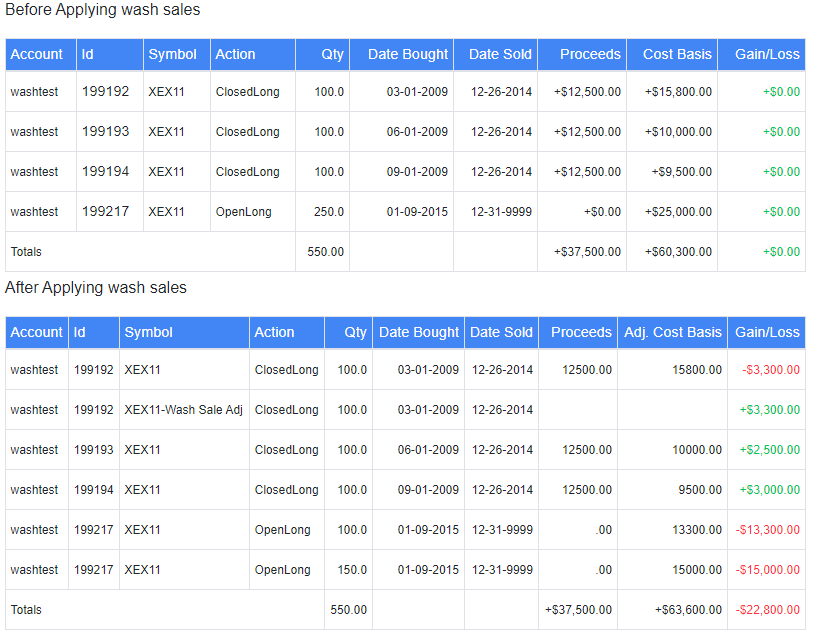

Scenario 4

During 2009, you bought 100 shares of X stock on each of three

occasions. You paid $158 a share for the first block of 100

shares, $100 a share for the second block, and $95 a share for

the third block. On December 26, 2014, you sold 300 shares of X

stock for $125 a share. On January 9, 2015, you bought 250

shares of identical X stock. You cannot deduct the loss of $33

a share on the first block because within 30 days after the

date of sale you bought 250 identical shares of X stock. In

addition, you cannot reduce the gain realized on the sale of

the second and third blocks of stock by this loss.

Scenario 5

There are multiple possible replacement lots, that were all

bought and sold on the same day. Since there are no replacement

lots with the same number of shares as the loss, the one with a

greater number of shares is used.

Scenario 6

The first lot is a loss, and washes against part of the second

lot. The part of the second lot that was used for the wash is

itself a loss, so it washes against the third lot. The remainin

2 shares of the second lot are also a loss, and they wash

against part of the fourth lot.